The Amazing Benefits of CapCut Mod APK

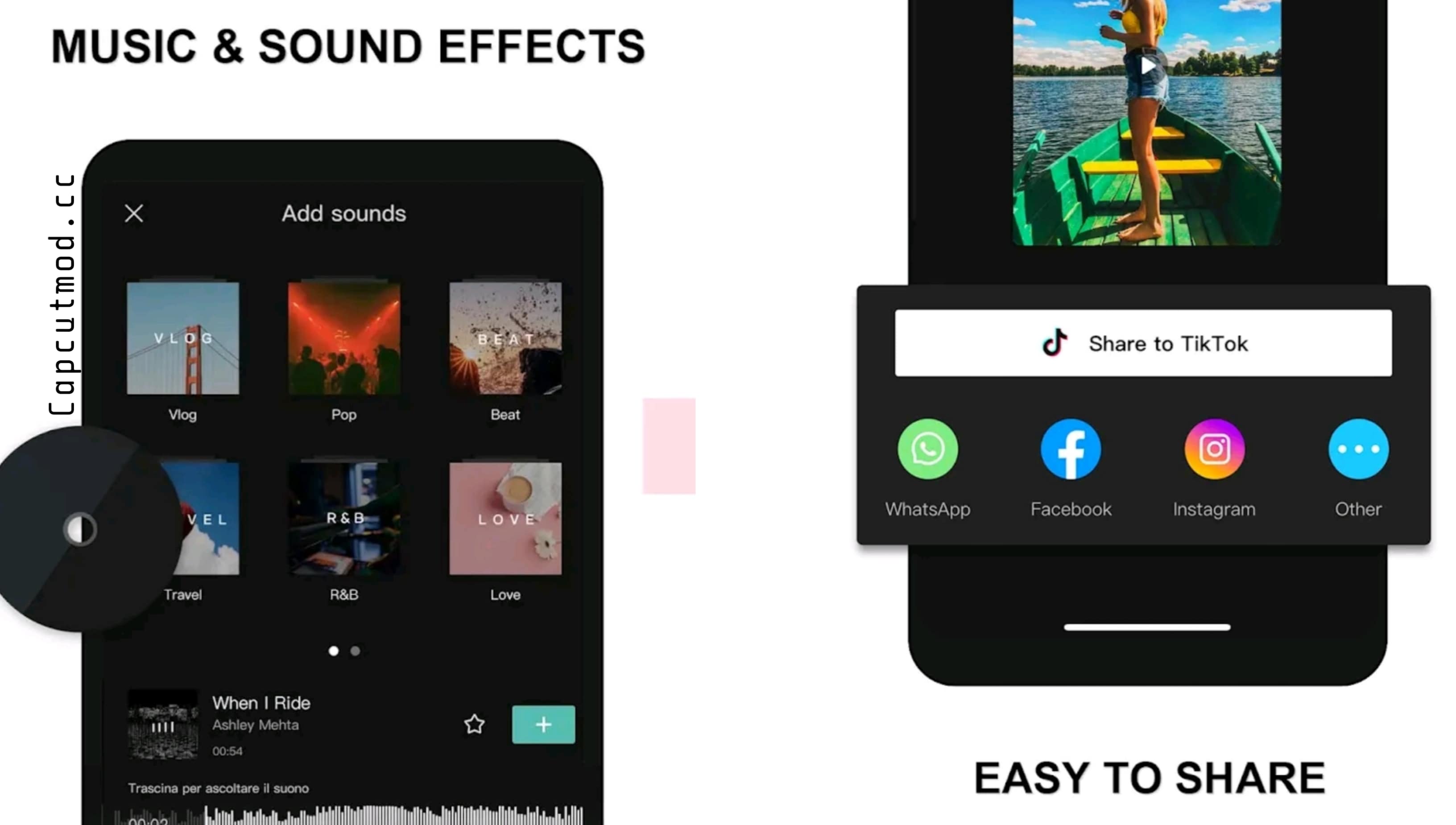

In a place where creativity is usually crucial for private and even professional growth, getting the right resources to show that imagination can be quite a game corriger. One application that will has recently captured the attention of creators is CapCut Mod APK. This specific powerful video using tool not only enhances your articles creation experience although also unlocks various benefits that can easily significantly boost your creative output. Simply by exploring the amazing advantages of CapCut Mod APK, a person may know how this can transform your approach to video editing and storytelling.

Through its user-friendly software to advanced editing features, CapCut Mod APK offers a special blend of operation and creativity. If you are a beginner planning to polish your abilities or an experienced editor seeking brand new avenues for appearance, this app provides an array of tools of which make video development accessible and enjoyable. As we look into the various rewards, you'll learn just how CapCut Mod APK can help elevate your projects, engage your current audience, and eventually, unleash your entire creative potential.

Essential Top features of a Good Personal loan

If considering a loan, it is crucial to evaluate the main element features that can drastically impact your economic well-being. One regarding the foremost factors to consider is usually the interest. A competitive interest rate can save you the substantial amount above the life of the particular loan and will be often a benchmark for assessing the entire cost. Fixed costs provide stability, enabling you to budget effectively, whilst variable rates might seem appealing at very first but can prospect to uncertainty in the event that market conditions transform.

One other essential feature will be the transparency of the particular loan agreement. A new good loan need to have clear phrases without hidden costs or complex lingo that can obscure your understanding of the particular commitment you will be entering into. This visibility not only builds trust with the particular lender but also enables you to help make an informed selection. Scrutinizing the arrangement for details many of these as loan span, repayment terms, and penalties for late payments is important.

Lastly, look at the flexibility of repayment options. A loan which allows for early repayment or perhaps offers various payment plans can accommodate changes in economical situation, ensuring of which you're not closed in to a rigid framework. This flexibility can certainly be especially essential in times associated with economic uncertainty, allowing you to control your repayment timetable without additional tension. Evaluating these characteristics will provide the solid foundation with regard to choosing a mortgage that aligns together with your financial objectives.

Evaluating Loan Suitability regarding Your Needs

When contemplating a loan, the 1st step is to identify your specific financial goals. No matter if you need some sort of personal loan regarding unexpected expenses, a home loan for purchasing some sort of home, or even an enterprise loan for growing your operations, learning the purpose of the loan is vital. This particular clarity will help you thin down loan options that align with your objectives and decreases the risk associated with overspending or deciding upon terms which experts claim not really fit your monetary situation.

Next, assess the particular various loan functions that are important for your needs. Intended for instance, interest levels participate in a significant part in the total cost of a financial loan. Understanding the big difference between fixed plus variable rates could guide you in choosing the right option. Additionally, consider https://modcapcuts.com/ , as loans together with favorable terms may ease financial tension and avoid potential pitfalls. Look intended for transparency in the loan agreement, making sure you comprehend any kind of hidden fees or even conditions that may possibly apply.

Finally, it is essential to examine multiple loan gives before making a choice. Each lender may possibly present different phrases, interest rates, and costs, so evaluating these types of options is essential to finding a bank loan that won’t put in danger your long-term economical health. Take in serious consideration your budget and help to make sure the loan’s monthly payments match comfortably within that. This thorough examination will empower you to definitely make an educated decision and safeguarded financing that genuinely meets your requirements.

Guidelines for Comparing Loan Offers Effectively

When assessing loan offers, begin by examining the interest rates shown by different loan providers. The interest rate significantly affects the overall expense of the loan, so it's important to appearance beyond the minimal rate and consider the apr (APR), which includes fees and other expenses. A lesser APR can potentially save you a new considerable amount over the life associated with the loan. Check out understand whether the rate is set or variable, as this make a difference the payments and monetary stability in typically the long run.

Next, carefully review the bank loan conditions and terms. Look for important factors including repayment flexibility, the size of the loan, and any penalties for early repayment. Some loans might provide attractive rates nevertheless have hidden conditions that could drawback you later on. Be sure to understand each and every component of the bank loan agreement before making some sort of commitment, as quality on these phrases will help an individual make an informed decision that aligns with your economic goals.

Finally, don't skip the importance of lender reputation when comparing financial loan options. Research the particular lenders you are usually considering by reading through reviews and scores from past consumers. A lender along with a strong popularity for customer assistance and transparency will be likely to give a smoother borrowing expertise. Additionally, communicating directly with lenders can assist you gauge their responsiveness and willingness to answer your questions, which usually is vital throughout choosing a mortgage that truly fulfills your needs.